8 February, 2012

A Significant Break to the Upside by the Euro!

The very bullish outlook for the Euro, which I have maintained though out the sovereign debt crisis, continues to look good. This latest break to the upside is extremely significant. The ultimate barometer of the state of the European Union has been resilient throughout the crisis of the last two years. Forecasts of parity to the US dollar proving to be the absolute nonsense that I said they were at the time.

The Euro-zone will achieve positive GDP growth this year.

The worst of the sovereign debt crisis has been patently behind us for many months now.

The Euro has been consolidating, just waiting for the weight of overwhelming and ridiculous bearish sentiment to begin to lift.

I am not sure if the consensus has shifted that much, but it looks very much to me like, and similar to the equity market of a few months ago, that the bears are absolutely and completely exhausted. The key point however is that they are still caught short the Euro, so what to do? I suggest they should panic and buy back their shorts as quickly as they can. This could be a particularly powerful Euro rally!

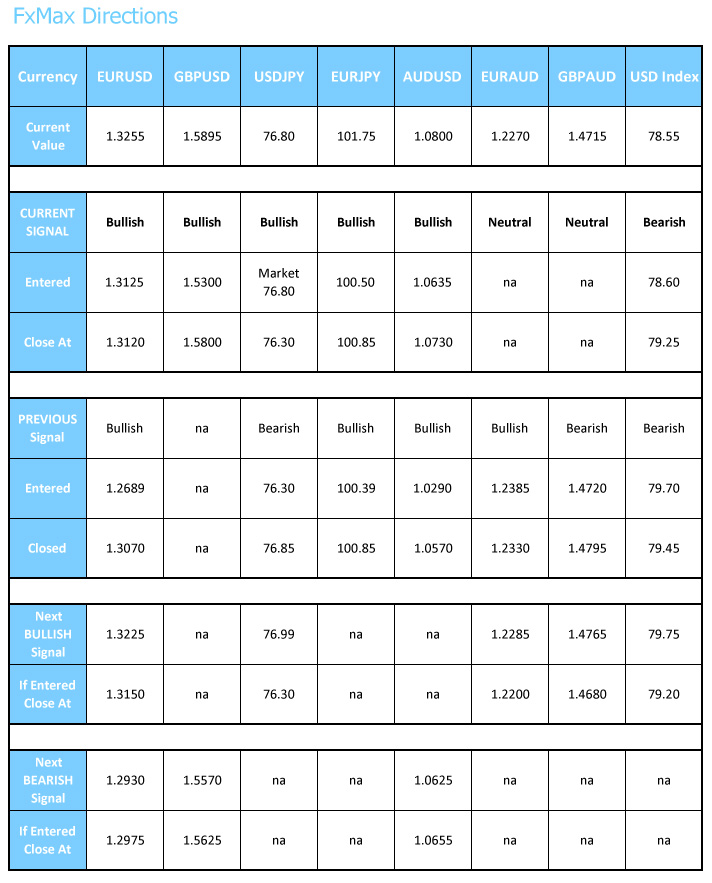

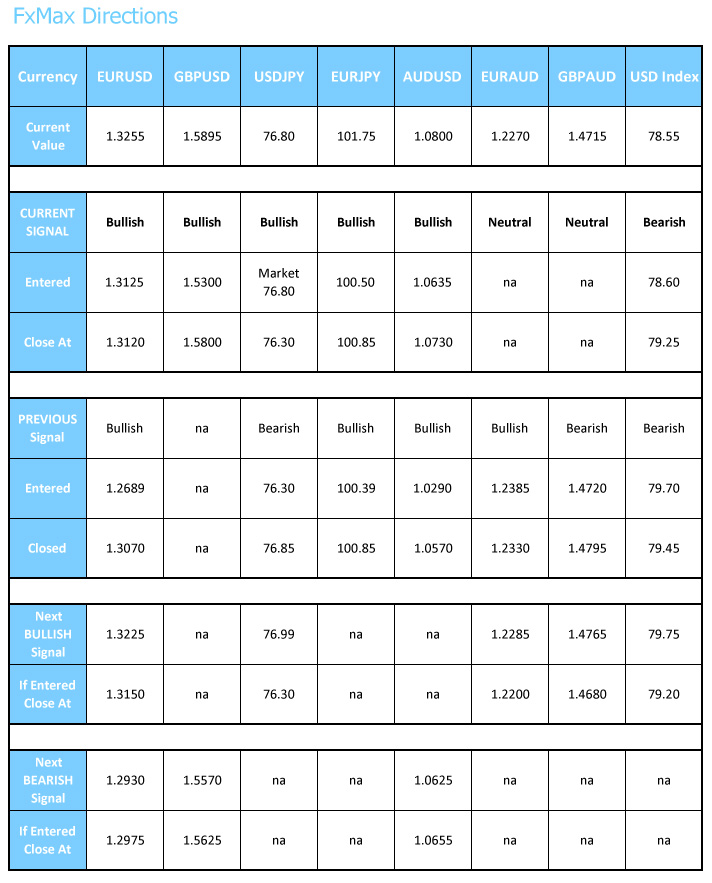

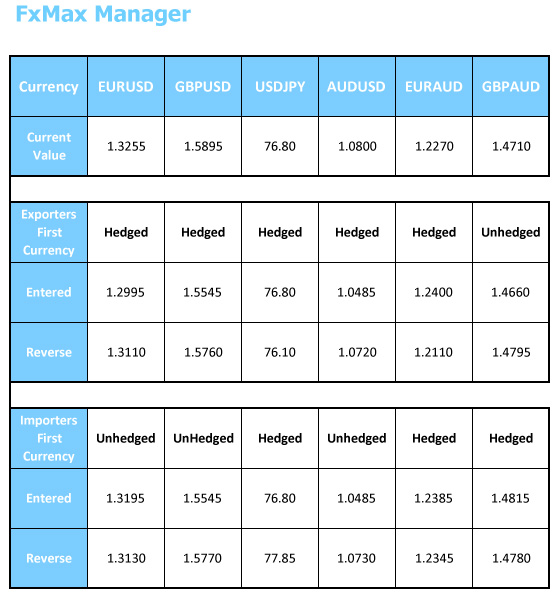

This range break to the upside was pre-empted here in view, and also in our FxMax Directions signals. If you are similarly well positioned, then you are likely to enjoy a lasting and quite substantial up move from these current levels, all the way to US$1.3600 and US$1.3900 in the near term. The medium term outlook remains US$1.4900 to US$1.5200. We may have already seen the lows for the year.

The only risk is some last minute collapse of the arrangements regarding Greece. This is considered highly unlikely, but it is not impossible. Nevertheless the Euro would quickly recover from such a shock, to continue to trend higher. For the moment though, just in case, certainly keep stop loss orders in place below the current market.

Overall our very own bullish view is the one that is being encouraged by both geo-political developments, and the actual price action.

Clifford Bennett

The very bullish outlook for the Euro, which I have maintained though out the sovereign debt crisis, continues to look good. This latest break to the upside is extremely significant. The ultimate barometer of the state of the European Union has been resilient throughout the crisis of the last two years. Forecasts of parity to the US dollar proving to be the absolute nonsense that I said they were at the time.

The Euro-zone will achieve positive GDP growth this year.

The worst of the sovereign debt crisis has been patently behind us for many months now.

The Euro has been consolidating, just waiting for the weight of overwhelming and ridiculous bearish sentiment to begin to lift.

I am not sure if the consensus has shifted that much, but it looks very much to me like, and similar to the equity market of a few months ago, that the bears are absolutely and completely exhausted. The key point however is that they are still caught short the Euro, so what to do? I suggest they should panic and buy back their shorts as quickly as they can. This could be a particularly powerful Euro rally!

This range break to the upside was pre-empted here in view, and also in our FxMax Directions signals. If you are similarly well positioned, then you are likely to enjoy a lasting and quite substantial up move from these current levels, all the way to US$1.3600 and US$1.3900 in the near term. The medium term outlook remains US$1.4900 to US$1.5200. We may have already seen the lows for the year.

The only risk is some last minute collapse of the arrangements regarding Greece. This is considered highly unlikely, but it is not impossible. Nevertheless the Euro would quickly recover from such a shock, to continue to trend higher. For the moment though, just in case, certainly keep stop loss orders in place below the current market.

Overall our very own bullish view is the one that is being encouraged by both geo-political developments, and the actual price action.

Clifford Bennett

Clifford Bennett

Chief Economist

White Crane Group

Sydney, Australia.

+61 (0) 423 950 427

clifford@whitecranegroup.com.au

www.whitecranegroup.com.au

No comments:

Post a Comment