20 February, 2012

Getting Exactly The Euro Rally As Forecast

The Euro will continue to strengthen substantially. This is only the beginning. Expect a long term historical re-pricing of the Euro to much higher levels, especially against the US dollar.

This is necessary so as to accurately reflect the new value of the Euro as representing the largest economy in the world, one where corporate profits are strong and continuing to increase, one where unemployment has probably just peaked, and its newfound status as the most fiscally responsible economic union henceforth, and last but not least its roll as the only viable alternative reserve currency to the US dollar. Furthermore I continue to highlight, against the consensus, that Euro-zone GDP will grow by 2.00% this year. The market has severely mispriced the Euro lower on completely misguided notions of severe recession, disintegration, contagion, and all of these erroneous beliefs now have to be repriced out of the market as well.

We are looking at just the start of our forecast Euro Grand Bull Market.

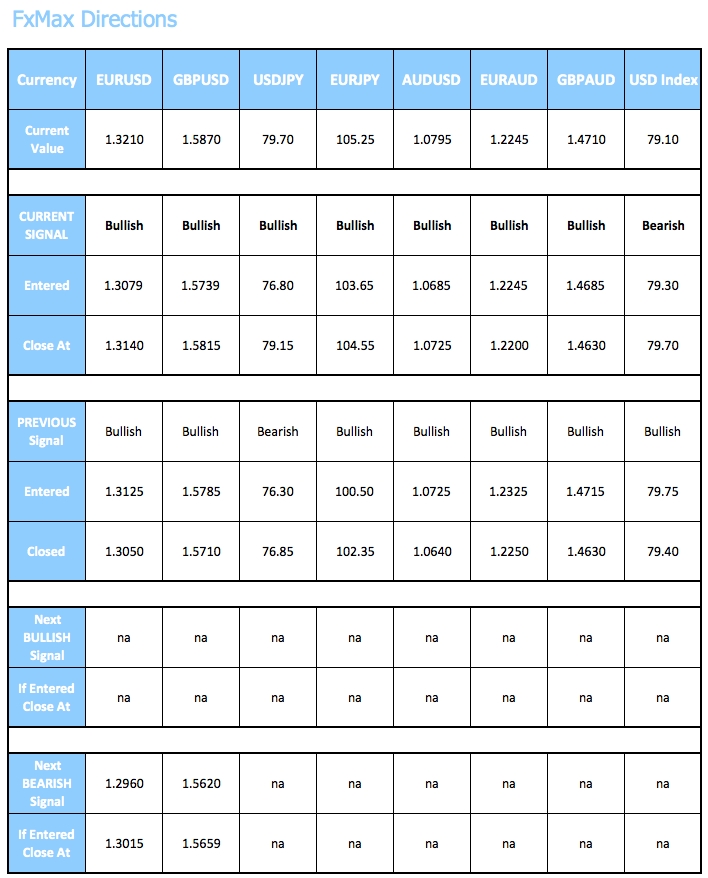

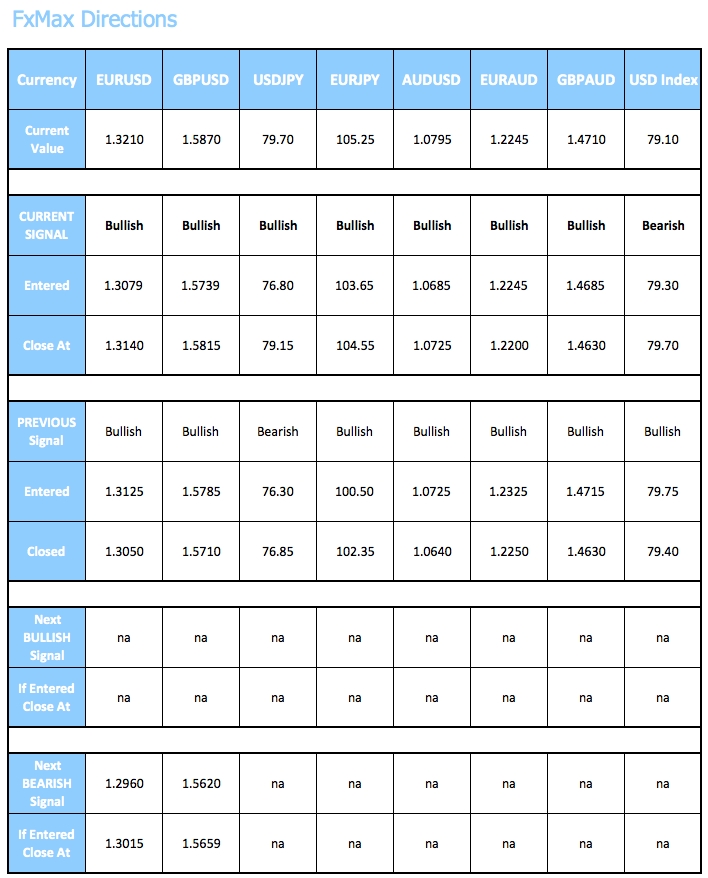

The support area 1.3080 to 1.3130 will intensify considerably now, and should hold any pullback. More likely immediate support at 1.3165 will now hold for further upward acceleration. Minor resistance is at 1.3255, then 1.3330 and 1.3485. This market is on its way to 1.4600 1.4900, then 1.5200 1.5600 in a big picture sense. Very bullish !

Australian Dollar Up Up and Away!

The Australian dollar is right now launching into its next great upswing stage. If you are an exporter you have no excuse for not hedging. The market gave you every opportunity around parity and lower.

A nation of just 23 million people sitting on one of the world’s most valuable pile of rocks, in the midst of the greatest economic expansion the world has ever seen. Where else did you think the currency was going to go. Of course if you had listened to the mostly US driven media headlines and commentary about China being a pack of cards and Europe about to dis-integrate, then you may have missed the chance to buy this year’s most valuable currency. At White Crane we stuck to recommending buying every dip, and it is working, and will continue to work. The Australian dollar forecast at the start of the year was for 1.1300, when it was at parity, but the quick start to the year had us upgrade that forecast for this year to 1.1700. Yes, it would be one of the biggest currency moves in history, and that is how good the fundamental backdrop to the Australian dollar is.

The Australian dollar will continue to be strong because our mining companies developed to world leaders in their industry, allowing them to take full advantage of the economic miracle that continues to run apace just to the north.

Despite poor government and a central bank that simply doesn’t understand, the Australian dollar and the economy will continue to be carried high by the mining industry.

Strong support 1.0670 1.0720 is now likely to hold any pullback, and more likely the immediate support at 1.0745 or even 1.0785 will now hold for continued strong gains. Expect upward acceleration rather than any pullback. Resistance is at 1.0855 then 1.0965, but this market is clearly going a lot higher with one of the nicest and most constructive consolidation phases I have seen in any market for quite some time, now coming to an end.

Clifford Bennett

The Euro will continue to strengthen substantially. This is only the beginning. Expect a long term historical re-pricing of the Euro to much higher levels, especially against the US dollar.

This is necessary so as to accurately reflect the new value of the Euro as representing the largest economy in the world, one where corporate profits are strong and continuing to increase, one where unemployment has probably just peaked, and its newfound status as the most fiscally responsible economic union henceforth, and last but not least its roll as the only viable alternative reserve currency to the US dollar. Furthermore I continue to highlight, against the consensus, that Euro-zone GDP will grow by 2.00% this year. The market has severely mispriced the Euro lower on completely misguided notions of severe recession, disintegration, contagion, and all of these erroneous beliefs now have to be repriced out of the market as well.

We are looking at just the start of our forecast Euro Grand Bull Market.

The support area 1.3080 to 1.3130 will intensify considerably now, and should hold any pullback. More likely immediate support at 1.3165 will now hold for further upward acceleration. Minor resistance is at 1.3255, then 1.3330 and 1.3485. This market is on its way to 1.4600 1.4900, then 1.5200 1.5600 in a big picture sense. Very bullish !

Australian Dollar Up Up and Away!

The Australian dollar is right now launching into its next great upswing stage. If you are an exporter you have no excuse for not hedging. The market gave you every opportunity around parity and lower.

A nation of just 23 million people sitting on one of the world’s most valuable pile of rocks, in the midst of the greatest economic expansion the world has ever seen. Where else did you think the currency was going to go. Of course if you had listened to the mostly US driven media headlines and commentary about China being a pack of cards and Europe about to dis-integrate, then you may have missed the chance to buy this year’s most valuable currency. At White Crane we stuck to recommending buying every dip, and it is working, and will continue to work. The Australian dollar forecast at the start of the year was for 1.1300, when it was at parity, but the quick start to the year had us upgrade that forecast for this year to 1.1700. Yes, it would be one of the biggest currency moves in history, and that is how good the fundamental backdrop to the Australian dollar is.

The Australian dollar will continue to be strong because our mining companies developed to world leaders in their industry, allowing them to take full advantage of the economic miracle that continues to run apace just to the north.

Despite poor government and a central bank that simply doesn’t understand, the Australian dollar and the economy will continue to be carried high by the mining industry.

Strong support 1.0670 1.0720 is now likely to hold any pullback, and more likely the immediate support at 1.0745 or even 1.0785 will now hold for continued strong gains. Expect upward acceleration rather than any pullback. Resistance is at 1.0855 then 1.0965, but this market is clearly going a lot higher with one of the nicest and most constructive consolidation phases I have seen in any market for quite some time, now coming to an end.

Clifford Bennett

Clifford Bennett

Chief Economist

White Crane Group

Sydney, Australia.

+61 (0) 423 950 427

clifford@whitecranegroup.com.au

www.whitecranegroup.com.au