EUR/USD

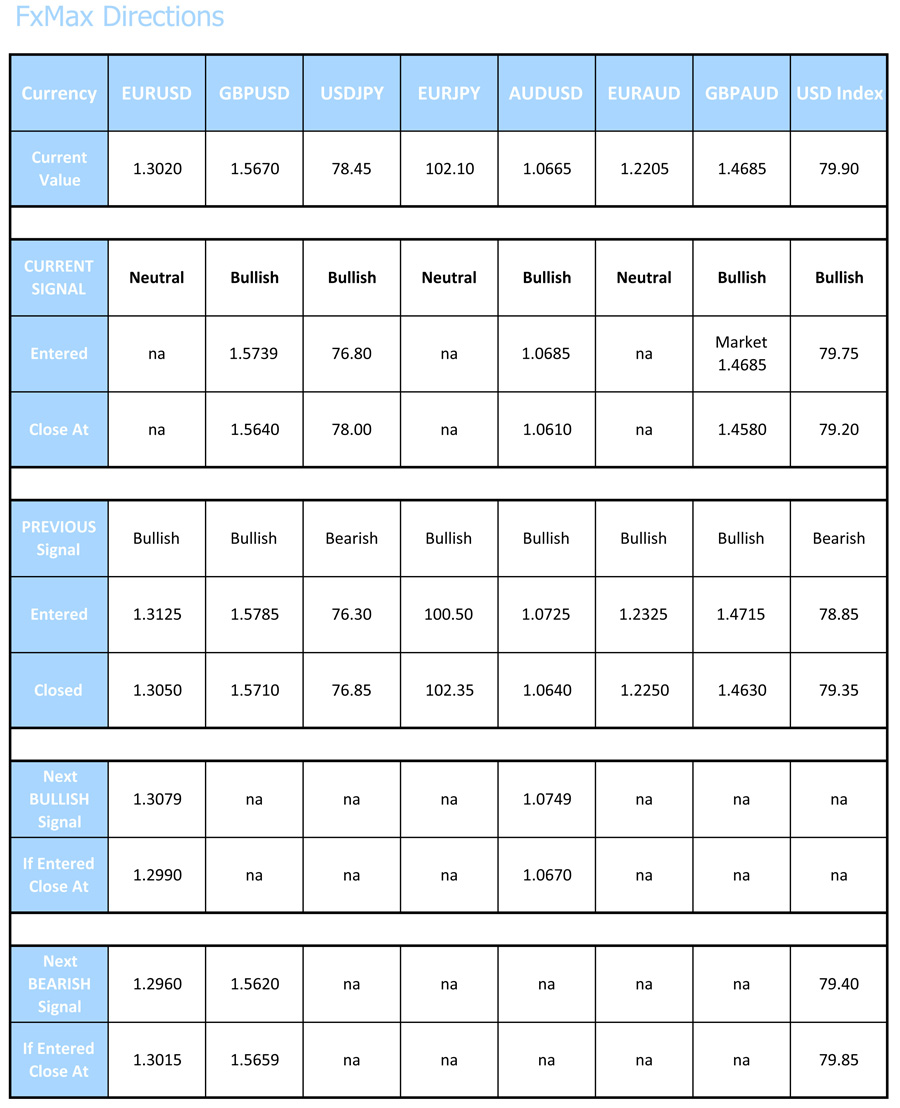

Short term pain, followed by long term gain, is how I would still characterise the Euro. We are testing major support which I felt was an outside chance, but is now under quite a lot of immediate pressure. We do need to respect this immediate downside pressure on the day which is being driven by the mis-interpretation of political posturing as a real threat to the Greek solution, and, by the huge number of stop loss and fresh sell orders that probably exist below the 1.3020 to 1.2980 area. This support zone had perhaps become too obvious for its own good. In these circumstances there is often a run at the stops by the major banks at the European open, only for the market to rally back later in the day, with everyone stopped out.

Would suggest respecting the immediate downward pressure while resistance at 1.3075 contains. While a break back above there would signal a surprise bottom to most people had been seen. Overall continue to favour the upside, but have to be cautious at first going into Europe.

As for the Australian dollar, it remains the most likely candidate for strongest currency in the world this year. Continue to buy on any and all dips.

Clifford Bennett

The White Crane Report

And so it continues

Far from the strong up day I was expecting, the US markets had some more consolidation to deliver.

The equity market really is range trading here, and this price action could have more to do with being at strong highs near previous major resistance, than any real fundamental pressure. The US equity market is close to a sharp acceleration phase to the upside, and as always presages such a move, no one wants to be the first to pull the trigger just in case they are wrong. The comfort zone for many a major fund manager, and even individual investors, is that there are still concerns about Greece and therefore that’s the excuse for not doing anything.

It is a game of trying to appear wise, after already having missed a huge rally.

A lot of people actually want Greece to default now, as its their only way out of having got it so very wrong for the last five months, as the market has steadily trended higher. The view here remains as it has been for the last two years, that Greece will get through this, there is zero risk of contagion, and Europe’s private sector is in strong health with higher and higher profits being delivered on a quarterly, let alone annual, basis.

Portugal actually had to increase the amount of paper on offer yesterday to satisfy insatiable investor demand. Yet still, we hear plenty of nonsense, particularly from one large US hedge fund yesterday, that Greece will be the start of global contagion. Yet their funds had losses ranging from 19% to 51% last year. So do not be mis-lead by some so called big names talking of disaster, for they are merely talking their under-water books.

As I have said before, even if Greece were to fully default, and leave the Euro, this would only lead to a much stronger Euro-zone economy, and Euro. For there would be no contagion, just a jettisoning of the worst part of the union, leaving the remainder all the stronger for the experience. Of course the mindless knee-jerk response would be to sell the Euro, but you could be sure the ECB and other central banks would quickly intervene to stabilise things. That would give the crazy investment herd time to realise that an exit by by Greece, was actually a good thing for Europe in the long run.

The central scenario here remains that the Euro is a Win Win trade. If Greece gets through this, the Euro is a buy, if Greece defaults the Euro is a buy!

Greece will get the funding it needs on February 20th. It is almost as if a “need for drama” possesses the Europeans at times, and it is indeed high drama that they have created on this occasion. Still, you get the sense markets are becoming, as they should, less sensitive to events in Greece or Europe for that matter. Global markets are increasingly aware of what we have been saying in The White Crane Report for a long time, that global growth is more about the “new first world” of Asia and Latin America in any case.

It is expected that there will be significant political grand standing regarding funding Greece, but in the end Greece will be secured by the greater union of Europe. Once this is done, there will no longer be any excuse for the global investment community to be under weight equities, and the Great Race to Own Shares will commence!

Again today I Suggest buying the dip, as when the eventual break to the upside occurs, there will be little liquidity on the sell side.

Clifford Bennett

Clifford Bennett

Chief Economist

White Crane Group

Sydney, Australia.

+61 (0) 423 950 427

clifford@whitecranegroup.com.au

www.whitecranegroup.com.au