9 February, 2012

Australian dollar a touch tired after the sprint

Euro still firming nicely for the Athens results

Overall global markets have been relatively stable over the last couple of days, the exception being the Australian dollar’s brief but impressive sprint higher.

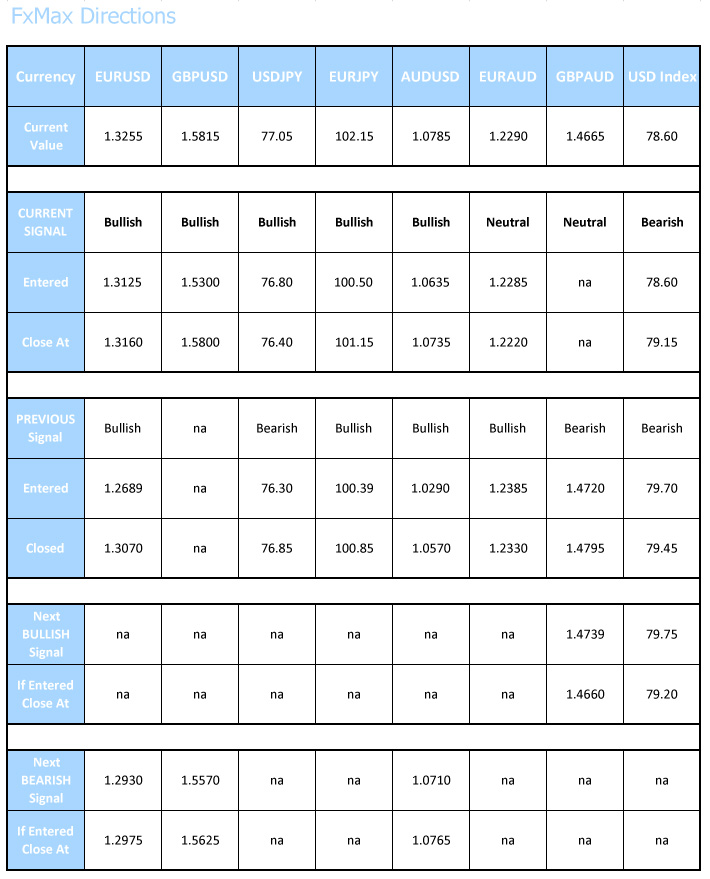

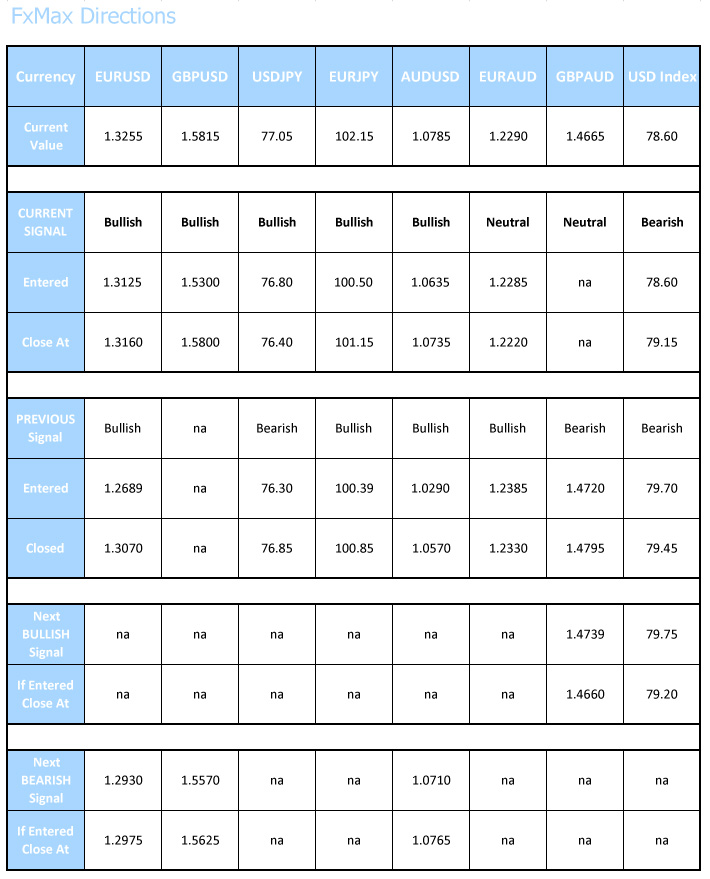

Relative global market stability, albeit with a distinct bias to the upside, is what we have been forecasting, and are seeing. The Euro is holding up very well, with some slight intra-day volatility, perhaps more pronounced in Sterling, as the news flow out of Greece ebbs and flows. The overall view on European currencies however, remains decidedly bullish, with the worst of the crisis well and truly behind us, and the economic outlook, particularly the private sector decidedly more positive than the consensus view. Then there is the “only viable alternative reserve currency” factor, which is a favourite of mine and could possibly come to the fore this year.

Euro outlook is for some short term consolidation energy building here, with a significant break to the upside against the US dollar still favoured. Immediately 1.3060 1.3365 wide, 1.3185 1.3275 narrow. Testing the downside at first, but favour buying on the dip.

The Australian dollar is looking a little tired after that sharp run to the upside across the board earlier this week. Remember the RBA did not hike rates, but merely kept them at the same level. While taking out the short sellers who were oddly expecting there to be a series of rate cuts, the yield advantage story is probably fully priced for the moment. Subsequently we could see the Australian dollar lower over the day, or next couple of days, but the dominant risk remains very much to the upside.

Immediately 1.0690 1.0875 wide, 1.0745 1.0815 narrow. Similarly favour some downside testing at first, and would be a little patient with short term buying. A move above 1.0815 however would be a trigger that the low had already been seen in this consolidation pattern.

Clifford Bennett

Euro still firming nicely for the Athens results

Overall global markets have been relatively stable over the last couple of days, the exception being the Australian dollar’s brief but impressive sprint higher.

Relative global market stability, albeit with a distinct bias to the upside, is what we have been forecasting, and are seeing. The Euro is holding up very well, with some slight intra-day volatility, perhaps more pronounced in Sterling, as the news flow out of Greece ebbs and flows. The overall view on European currencies however, remains decidedly bullish, with the worst of the crisis well and truly behind us, and the economic outlook, particularly the private sector decidedly more positive than the consensus view. Then there is the “only viable alternative reserve currency” factor, which is a favourite of mine and could possibly come to the fore this year.

Euro outlook is for some short term consolidation energy building here, with a significant break to the upside against the US dollar still favoured. Immediately 1.3060 1.3365 wide, 1.3185 1.3275 narrow. Testing the downside at first, but favour buying on the dip.

The Australian dollar is looking a little tired after that sharp run to the upside across the board earlier this week. Remember the RBA did not hike rates, but merely kept them at the same level. While taking out the short sellers who were oddly expecting there to be a series of rate cuts, the yield advantage story is probably fully priced for the moment. Subsequently we could see the Australian dollar lower over the day, or next couple of days, but the dominant risk remains very much to the upside.

Immediately 1.0690 1.0875 wide, 1.0745 1.0815 narrow. Similarly favour some downside testing at first, and would be a little patient with short term buying. A move above 1.0815 however would be a trigger that the low had already been seen in this consolidation pattern.

Clifford Bennett

Clifford Bennett

Chief Economist

White Crane Group

Sydney, Australia.

+61 (0) 423 950 427

clifford@whitecranegroup.com.au

www.whitecranegroup.com.au

No comments:

Post a Comment