7 February, 2012

Still Bullish Euro and Australian Dollar

The Euro is marking time ahead of Greece progress and conclusion of talks. It is looking good at this albeit latish stage, and we should expect the Euro to burst higher at any moment. Sterling is likely to follow suit, as what is good for the Euro, is also of course good for Sterling. Please see The White Crane Report for further discussion of the situation in Greece. Whether Greece gets the next funding leg, almost a certainty, or not, the Euro will rally in the long run.

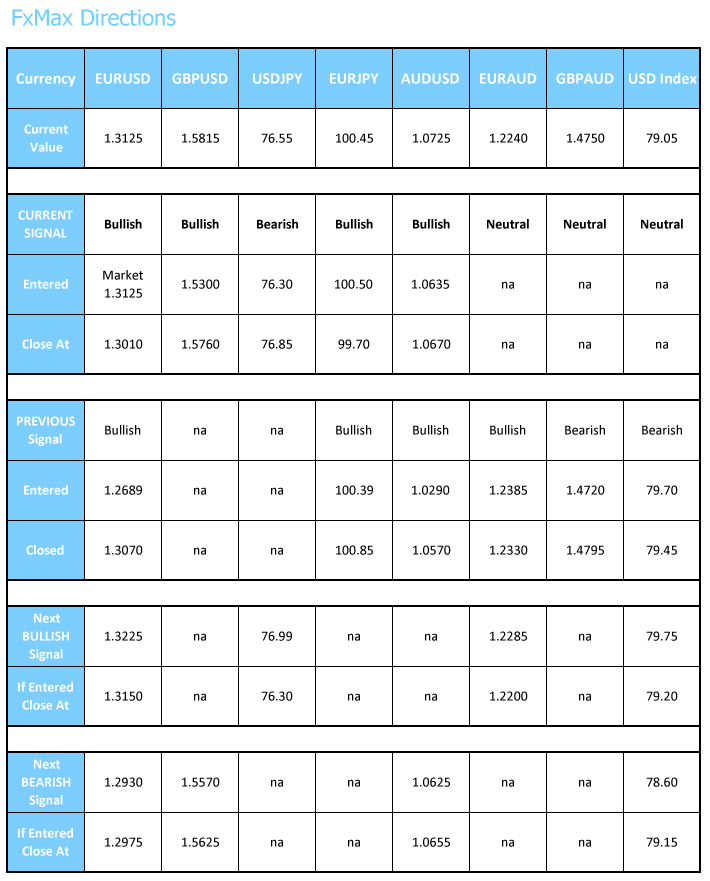

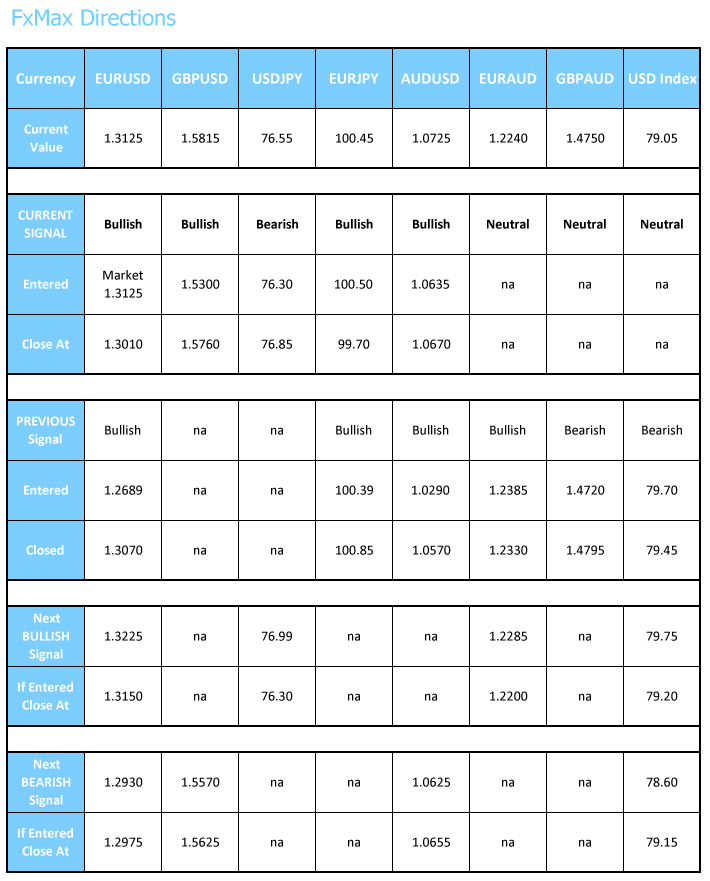

The US dollar is hesitating and attempting to make some sort of bottom after the recent decline, but the market needs to get above the USD Index 78.60 level to encourage this scenario, and I don’t think it can manage it.

As bullish the US economy as I am, there are sill a lot of long term structural issues for the US to work through, and prior global dominance factors yet to be priced out of the once mighty currency. As I again highlighted in a speech last night at Investorium in Sydney, the US “strong dollar policy” has for several years actually been, and indeed remains, “the orderly decline of the US dollar policy”.

This year’s forecast for the US dollar Index remains in the order of 70.00. If the market can recover 78.60, then we will reverse our view in the short term, but strongly favour further significant downside.

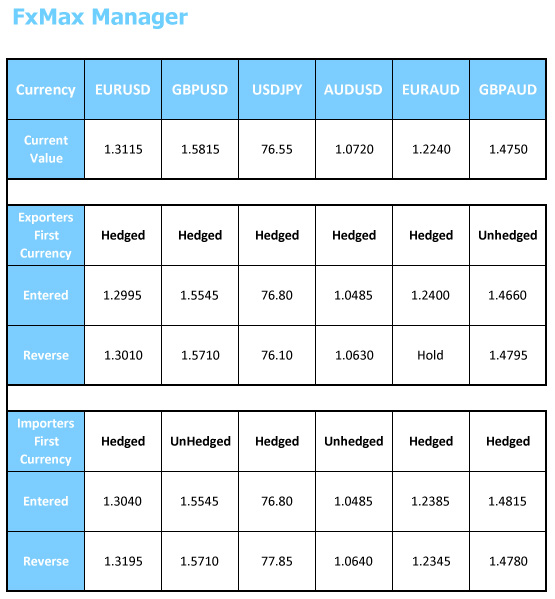

The Australian dollar is in the grip of Reserve Bank headlights today. The market clearly wants to rally, buyers abound! Yet we need to get this rate cut, if there is one, out of the way first. There is still a much stronger possibility for the Reserve Bank to remain on hold than the market anticipates, with little time having passed since the previous rate reductions, and strong demand for Australia’s resources continuing. The RBA could also throw into the mix the prospect for a positive resolution regarding Greece, though it may well focus on the current downside risks to the world’s largest economy, the Euro-zone.

All in all a rate cut should occur, though I am sticking to my no change forecast, and if it does, the Australian dollar may experience a brief fall. I would tend to be a buyer of the Australian dollar in any case however, 15 minutes after the announcement. The long term up-trend and fundamental argument is just that strong.

Clifford Bennett

The Euro is marking time ahead of Greece progress and conclusion of talks. It is looking good at this albeit latish stage, and we should expect the Euro to burst higher at any moment. Sterling is likely to follow suit, as what is good for the Euro, is also of course good for Sterling. Please see The White Crane Report for further discussion of the situation in Greece. Whether Greece gets the next funding leg, almost a certainty, or not, the Euro will rally in the long run.

The US dollar is hesitating and attempting to make some sort of bottom after the recent decline, but the market needs to get above the USD Index 78.60 level to encourage this scenario, and I don’t think it can manage it.

As bullish the US economy as I am, there are sill a lot of long term structural issues for the US to work through, and prior global dominance factors yet to be priced out of the once mighty currency. As I again highlighted in a speech last night at Investorium in Sydney, the US “strong dollar policy” has for several years actually been, and indeed remains, “the orderly decline of the US dollar policy”.

This year’s forecast for the US dollar Index remains in the order of 70.00. If the market can recover 78.60, then we will reverse our view in the short term, but strongly favour further significant downside.

The Australian dollar is in the grip of Reserve Bank headlights today. The market clearly wants to rally, buyers abound! Yet we need to get this rate cut, if there is one, out of the way first. There is still a much stronger possibility for the Reserve Bank to remain on hold than the market anticipates, with little time having passed since the previous rate reductions, and strong demand for Australia’s resources continuing. The RBA could also throw into the mix the prospect for a positive resolution regarding Greece, though it may well focus on the current downside risks to the world’s largest economy, the Euro-zone.

All in all a rate cut should occur, though I am sticking to my no change forecast, and if it does, the Australian dollar may experience a brief fall. I would tend to be a buyer of the Australian dollar in any case however, 15 minutes after the announcement. The long term up-trend and fundamental argument is just that strong.

Clifford Bennett

Clifford Bennett

Chief Economist

White Crane Group

Sydney, Australia.

+61 (0) 423 950 427

clifford@whitecranegroup.com.au

www.whitecranegroup.com.au

No comments:

Post a Comment